open end lease meaning

Open-End Lease is often referred to as a finance lease. Under standard terms leasing equipment such as trucks forklifts or trailers means making monthly payments set by the lessor.

5 Reasons Why You Should Buy Your Leased Car Autotrader

What Does Open-End Lease Mean.

. An equity lease also commonly referred to as an open-end lease TRAC lease finance lease or capital lease refers to a type of lease where the cost of the vehicle is depreciated a set amount each month until you reach a predetermined balance or zero balance at all. A lease providing for increases in rental payment at specified dates. At the end of each contract you have the option of paying the residual and owning the vehicle outright.

Most closed-end leases also have mileage restrictions between 16000-24000 kms per year. Save Time Money With Our Smart Form Builder. In a closed-end lease the lessor assumes the depreciation risk but the terms are more restrictive.

In an open-end lease you may receive a refund of any gain and you are responsible for any deficiency. A lease that may involve a balloon payment based on the value of the property when it. Finance leases called open-end leases are also called open-end agreements.

For example if your lease early termination payoff is 16000 and the amount credited for the vehicle is 14000 your early termination charge will be 16000 minus 14000 or 2000. This works well for employers since the cost of the vehicles can be written-off or. Generally higher monthly terms mean lower residuals and vice versa.

He will pay the bill if the depreciation is worse than expected. In a Nutshell. In contrast to a closed lease contract.

The most common type of car lease also known as a closed-end lease. Very simply in an open-end lease the lessee assumes the depreciation risk but has more flexible terms. Monthly payments are usually lower than the grant of hired purchase the purchase lease requires large payments when maturing.

Regulation M the term open-end lease means a consumer lease in which the lessees liability at the end of the lease term is based on the difference between the residual value of the leased property and its realized value. This payment scale is public when the lease terminates. This type of leasing is more often used for commercial purposes because the open-end lease gives unlimited mileages.

We asked lessors at three fleet leasing and management companies to dig a little deeper into both to help you determine the lease that works. The lease contract usually a car or means of transport in which payable payments completely debt. A companyemployer will assume management and leasing of the car to its employees not the leasing company.

Expertly Designed Simple Templates. Auto leases available to consumers fail into two categories - open-end operating leases and closed-end operating leases1 Under an open-end lease the lessee ie the consumer assumes risk regarding the market value of the leased auto at lease expiration. Normal wear and tear is typically more stringent with a closed-end lease compared to an open-end lease.

What Is a TRAC Lease. Amount credited is frequently about 5 percent below the wholesale value of the vehicle. Pros of Equity Leases Many companies utilize.

Ad Download Print E-Sign Your Customized Lease Agreement In 10 Minutes. The employer takes all the financial risk. In an open-end lease more common in business leasing the person or company leasing the vehicle takes on that risk but leasing terms may be more flexible.

In a closed-end lease the leasing company takes on the risk of any additional depreciation. When you lease a car youll usually be offered a closed-end lease. Equity Lease Read More.

During the end of the lease agreement an open-end lease requires the lessee or person making periodic lessee payments to pay a balloon payment equating the difference between the lease contracts residual value and fair market value. However the lessee is responsible for paying for any damages at the end of the lease that go beyond normal wear and tear. The open-end lease puts all the financial risks on the lessee.

Open-end leases also exist and are most often used in the case of commercial business lending. The amount that the dealership will credit you for the vehicle you provide as partial or full payment for another vehicle. A closed-end lease is a rental agreement that puts no obligation on the lessee the person making periodic lease payments to purchase the leased asset at the end of the.

We just have to think of transport and courier companies they prefer to amortize the real cost of.

How Do Car Leases Work Car Leasing Explained

What Is The Difference Between An Open Vs Closed Lease

![]()

Car Leasing Guide How To Lease A Vehicle Kelley Blue Book

Top 27 Lease Agreement Clauses To Protect Landlords

What Is The Difference Between An Open Vs Closed Lease

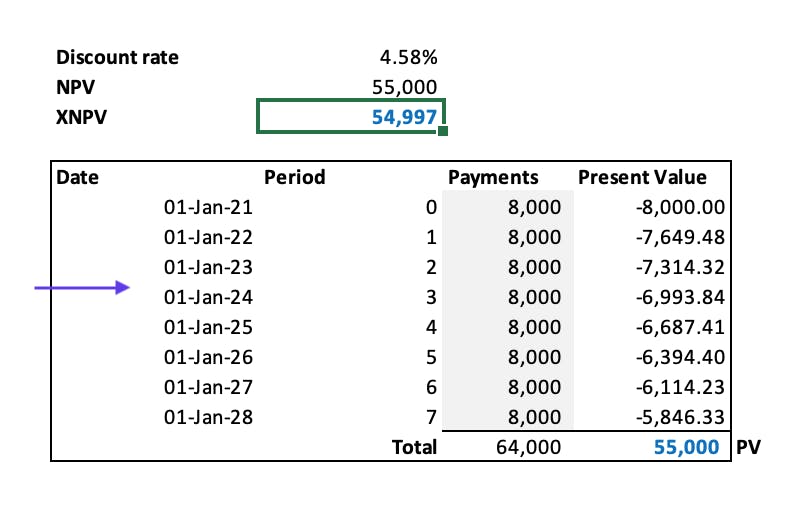

How To Calculate The Discount Rate Implicit In The Lease

What Is The Difference Between An Open Vs Closed Lease

/renting-vs-owning-home-pros-and-cons.asp-ADD-V2-2ce9de919eb94f62bd4e4c7a23010852.jpg)

Renting Vs Buying A Home What S The Difference

How To Profit From An Off Lease Car Kelley Blue Book

What Is Residual Value When You Lease A Car Credit Karma

Open Vs Closed End Leases What To Know Credit Karma

:max_bytes(150000):strip_icc()/GettyImages-912785590-bd21254b8f914ad1a28876e45800554c.jpg)

:max_bytes(150000):strip_icc()/7-mistakes-avoid-when-buying-used-car_V1-0310aafb63dc45bca11ae3a4487bf9a1.png)

:max_bytes(150000):strip_icc()/Short-Term_Car_Lease_GettyImages-1152293815-559b180c09644bb2985f5516d2a6a101.jpg)

/GettyImages-1149107425-99d2c7fcb6264e13bb34f7746eeabb0d.jpg)

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)

/renting-vs-owning-home-pros-and-cons.asp-ADD-V2-2ce9de919eb94f62bd4e4c7a23010852.jpg)